The intraday financing service is a specialized trading model designed by securities firms for sophisticated trading investors. By reading this article, you will have a comprehensive understanding of the concept, special rules, financing interest calculation methods, account opening and closing methods of the intraday financing service, and the operation methods for intraday trading.

1. Definition of intraday financing service

The intraday financing service is a specialized trading model designed by securities firms for sophisticated trading investors. The intraday financing service requires investors to open an intraday financing sub-account under the current securities firm account, and complete the transfer of funds or stocks between the main and sub-accounts to realize transactions under the intraday financing account.

2. Special rules for intraday financing accounts

Since the intraday financing service is aimed at the scenario of intraday trading, that is, to obtain the income brought by intraday stock price fluctuations through high-frequency low-buy and high-sell operations within a trading day, thus the intraday financing service has special restrictions on transaction quotas and risk control.

3. Trading amount

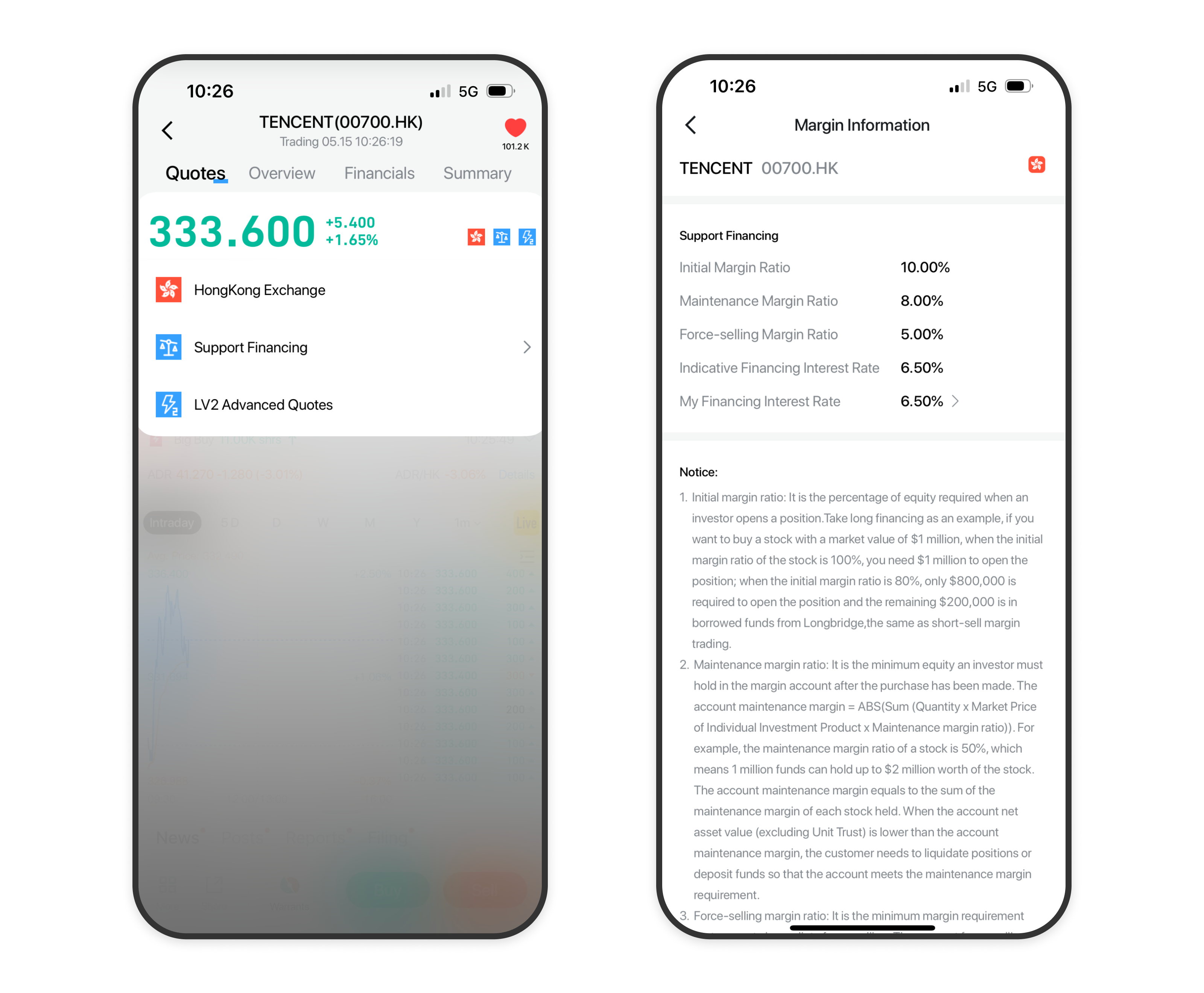

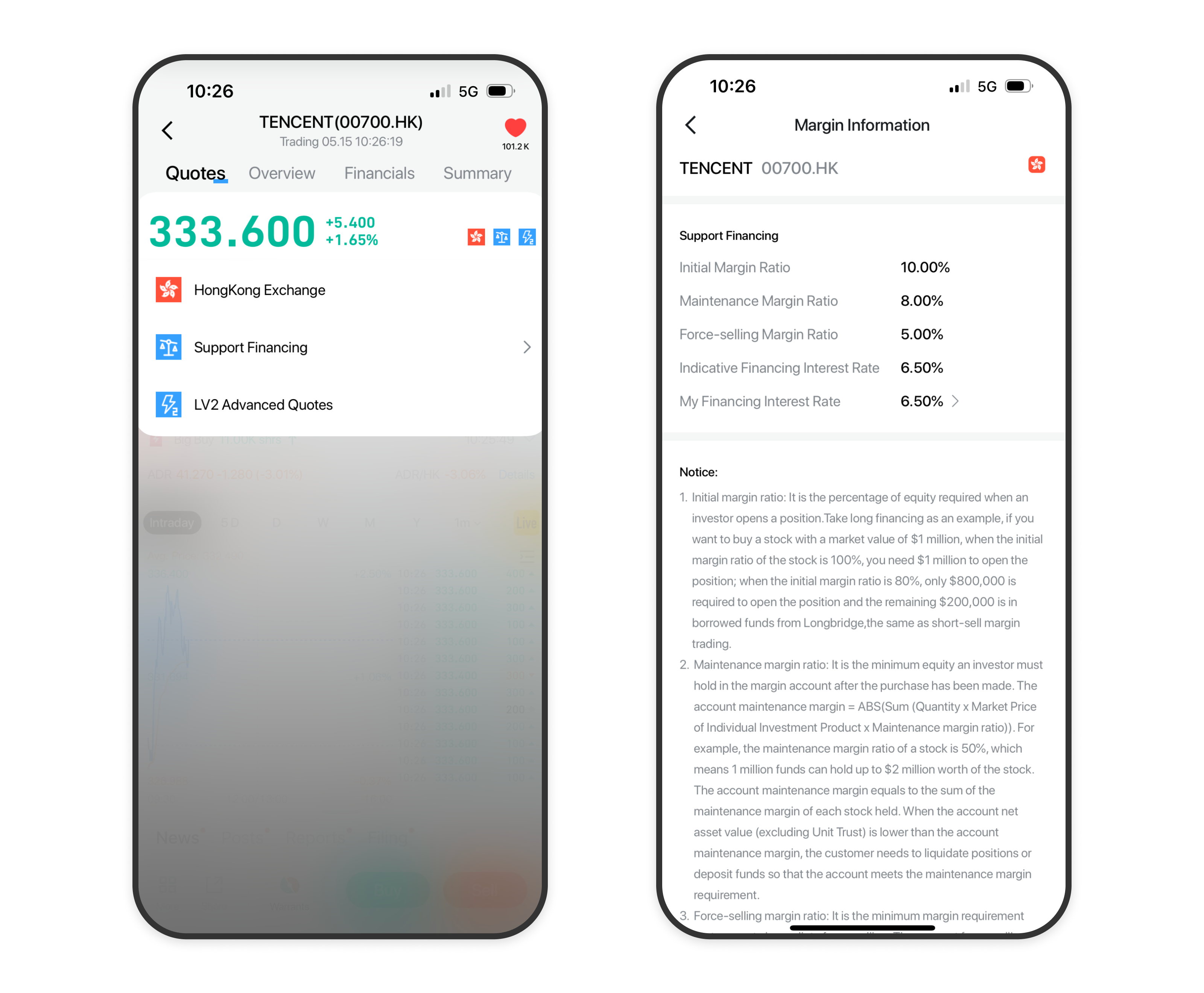

When trading stocks with intraday financing sub-accounts, relatively fewer margin requirements are required, that is, for the same amount of cash in the account, intraday financing sub-accounts can open more stock positions than ordinary securities accounts. After switching to the intraday financing sub-account, investors can click on the underlying financing details on the stock details page to view the margin requirements for the intraday financing sub-account.

4. Session

- HK stocks: High-leverage trading is available from the start of the continuous auction session (9:30) until 20 minutes before the close of the continuous auction session (15:40).

- US stocks: High-leverage trading is available from 30 minutes before the pre-market opening (4:30 ET) until 20 minutes before the close of the regular trading session (15:40 ET).

5. Risk control

To avoid the risk of overnight stock price fluctuations, for intraday financing sub-accounts, the system will adjust the initial margin requirement to 100% 20 minutes before the closing, that is, the margin required for opening a position is 100%, and the maintenance margin requirement will be adjusted to 100% 15 minutes before the closing. If a margin call is triggered or the account incurs arrears due to increased margin requirements, you should liquidate positions until all arrears are cleared. Failure to do so will activate the system's forced liquidation mechanism to ensure zero arrears at the closing of the market.

6. Method to calculate the interest on intraday financing service

The rules and interest rates for charging financing interest on intraday financing service are the same as those of ordinary securities accounts, that is, only the interest generated by the financing limit occupied by overnight positions will be charged, and no higher financing interest will be charged solely because intraday financing offers a higher credit line. Therefore, if you only conduct trading transactions within a day and liquidate your positions before the market closes without leaving overnight positions, no financing interest will be generated.

7. Method to open an intraday financing sub-account

You can submit an account opening application online through the intraday financing sub-account opening portal provided in the App, or click here.

8. Method to cancel or close the intraday financing sub-account

Currently, only offline customer service can be contacted to cancel or close the intraday financing sub-account.

9. Method to conduct intraday trading

The intraday financing service itself only represents a special type of account that can provide different transaction amounts and risk control rules. You can use the quick transactions or trading hall entrustment orders provided by the platform to conduct intraday financing operations. In order to better fit the order submission method of high-frequency intraday trading, you can also use the "Intraday Quick Trading Mode" provided by the platform for intraday trading operations. For specific function descriptions, please refer to: Intraday Quick Trading Mode

Key takeaways:

- Service model: Set up intraday financing sub-accounts for sophisticated investors, and realize transactions through transfers between the main and sub-accounts.

- Trading rules

- Limit: Low margin requirements, more stocks can be opened.

- Time period: High leverage trading is available at HK stocks on 9:30-15:40 and US stocks on 4:30-15:40 (ET).

- Risk control: 20 minutes before the closing, the initial margin requirement will be raised to 100% and 15 minutes before the closing, the maintenance margin requirement will be raised to 100%. Any account that remains under-margined will activate the system's forced liquidation mechanism.

- Interest calculation: Same as ordinary accounts, no interest will be accrued on positions that are not held overnight.

- Operation method

- Account opening and closing: Open an account online on the App, and contact customer service offline to close the account.

- Trading: Use quick trading, submit orders on the trading hallor use "Intraday Quick Trading Mode".

Disclosure

This article is for reference only and does not constitute any investment advice.